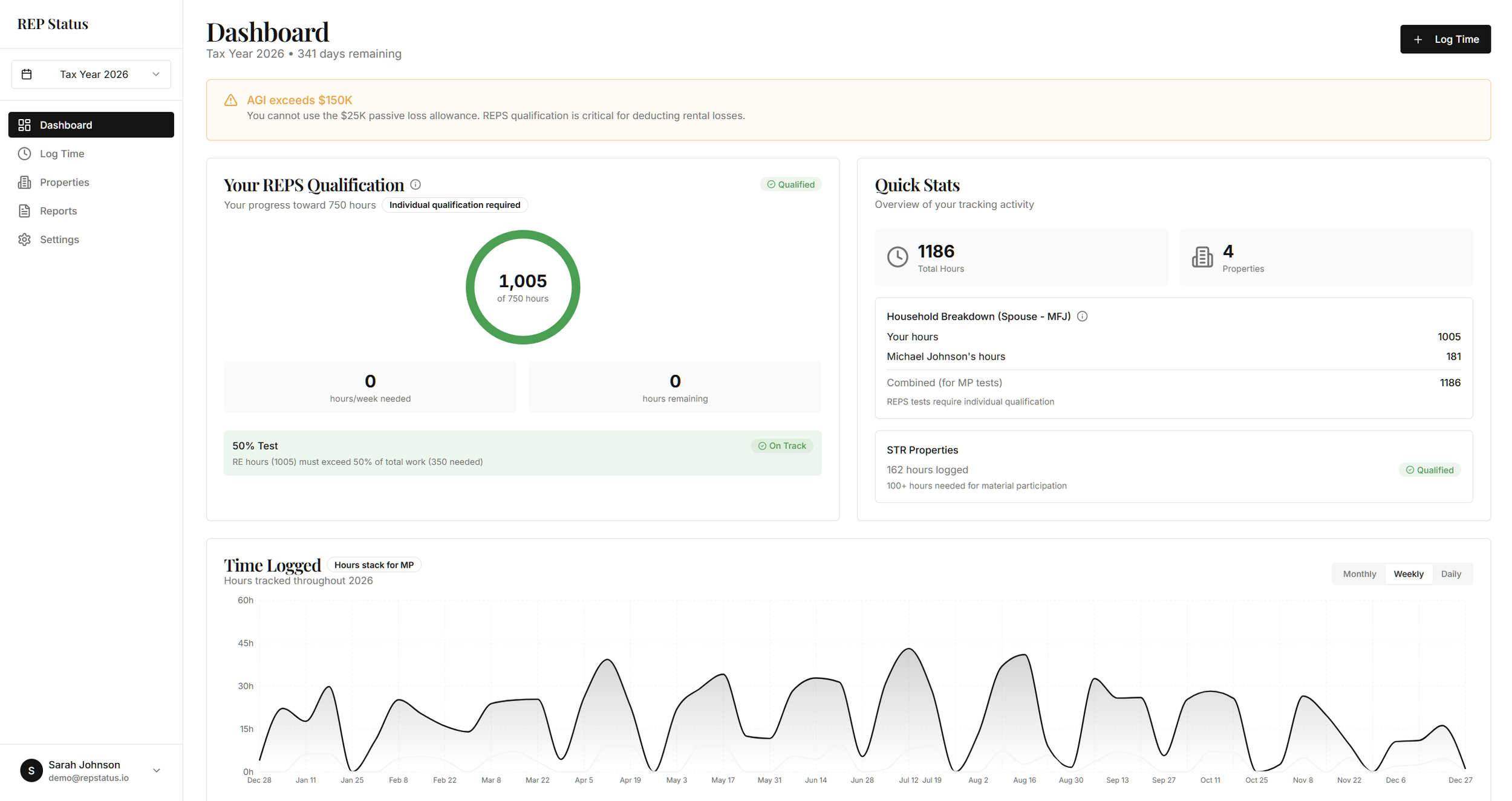

The "Holy Grail" of Tax Strategy: Why REP Status is Your Most Valuable Asset (And How the IRS Tries to Take It Away)

Passive losses generally can't offset active income—unless you unlock Real Estate Professional (REP) Status. Discover why this is the "Holy Grail" of the tax code, why the IRS is cracking down on it in 2026, and the new tool that makes compliance effortless.

Behind the Tax Savings: The 4 Key Documents You Need for a Seamless Cost Segregation Study

Maximize your real estate investment deductions. Before starting a Cost Segregation Study, make sure you have these 4 essential documents ready. Getting organized is the first step to unlocking massive tax savings.

Unlock Massive Tax Savings in 2025: How the "One Big Beautiful Bill Act" and Cost Segregation Create a Powerful Combo

The "One Big Beautiful Bill Act" (OBBBA) has permanently restored 100% bonus depreciation. For real estate investors, this is a game-changer. Learn how to combine this new law with cost segregation to unlock massive first-year tax deductions and significantly boost your cash flow.

The Handoff: What Every New HOA Board Member Needs to Know About Reserve Studies

Board turnover is inevitable in community associations, but institutional knowledge doesn't have to walk out the door. Learn what every new HOA board member needs to know about reserve studies, fiduciary duty, and avoiding costly mistakes in their first 30 days.

Supercharge Your Deductions: How the 2017 Tax Cuts Amplified Cost Segregation Benefits

The 2017 Tax Cuts and Jobs Act supercharged the benefits of Cost Segregation, especially through 100% bonus depreciation. Learn how this powerful combination allows real estate investors to significantly accelerate deductions and boost cash flow.

Fines Capped at $100: What California's New Law (AB 130) Means for Your HOA

A new California law, AB 130, now caps most HOA fines at $100. This guide explains the key changes to the Davis-Stirling Act and what your board must do now to ensure your association's enforcement policies are compliant.

Beyond the Bank Account: A Guide to Investing Reserve Funds for HOAs

Is your HOA's reserve fund losing purchasing power to inflation in a standard bank account? This guide explores the board's fiduciary duty to prudently invest funds, covering the core principles of safety, liquidity, and yield, plus strategies like CD ladders.

Beyond the Binder: 3 Critical Mistakes HOAs Make with Their Reserve Study

Getting a reserve study is the first step, but costly errors can undermine its value. Are you treating your study as a one-time report or deviating from the funding plan? Learn the three most common mistakes HOA boards make and how to avoid them.

The Smart Investor's Tax Strategy: What is a Cost Segregation Study?

Are you maximizing the tax deductions on your Airbnb or short-term rental? A Cost Segregation Study is an essential but often overlooked strategy for increasing your cash flow by accelerating depreciation. Discover how it can impact your bottom line.

The True Cost of Delay: Unpacking the Dangers of an Underfunded Reserve

An underfunded reserve can lead to a cascade of problems for any community association. From unpopular special assessments to deferred maintenance and declining property values, the true cost of delay is immense. Learn the key dangers and how to avoid them.

California's Reserve Study Law: A Quick Guide

Serving on a California HOA board? Understanding the Davis-Stirling Act's reserve study requirements is crucial for compliance. This quick guide breaks down your key legal obligations, from the 3-year site inspection to annual disclosures to members.

Why Your Community Needs a Reserve Study

How does your community plan for major future expenses like a new roof or road repairs? A Reserve Study is the most critical tool for protecting your property's value and avoiding sudden special assessments. Learn the core benefits of this essential financial plan.