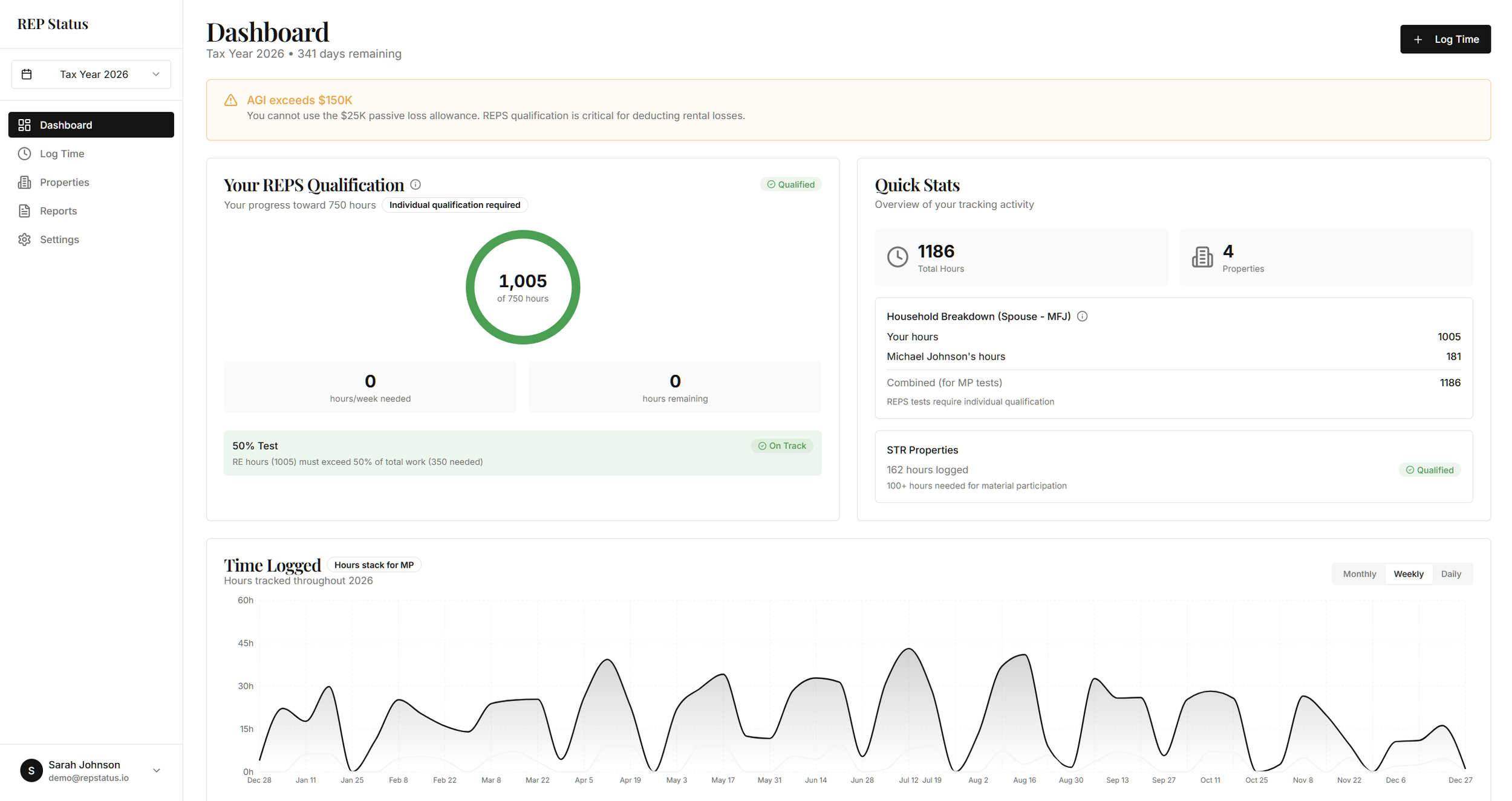

The "Holy Grail" of Tax Strategy: Why REP Status is Your Most Valuable Asset (And How the IRS Tries to Take It Away)

Passive losses generally can't offset active income—unless you unlock Real Estate Professional (REP) Status. Discover why this is the "Holy Grail" of the tax code, why the IRS is cracking down on it in 2026, and the new tool that makes compliance effortless.

Behind the Tax Savings: The 4 Key Documents You Need for a Seamless Cost Segregation Study

Maximize your real estate investment deductions. Before starting a Cost Segregation Study, make sure you have these 4 essential documents ready. Getting organized is the first step to unlocking massive tax savings.

Unlock Massive Tax Savings in 2025: How the "One Big Beautiful Bill Act" and Cost Segregation Create a Powerful Combo

The "One Big Beautiful Bill Act" (OBBBA) has permanently restored 100% bonus depreciation. For real estate investors, this is a game-changer. Learn how to combine this new law with cost segregation to unlock massive first-year tax deductions and significantly boost your cash flow.